Discover the Power of EquiFinOne

A modern platform built to streamline financial operations for NBFCs, microfinance institutions, cooperatives, credit societies, and fintechs.

How It Works with Apache Fineract

1. Configure Core Banking

Define loan products, savings accounts, interest rates, fees, and charges. Set up accounting rules, user roles, and organizational structures tailored to your institution.

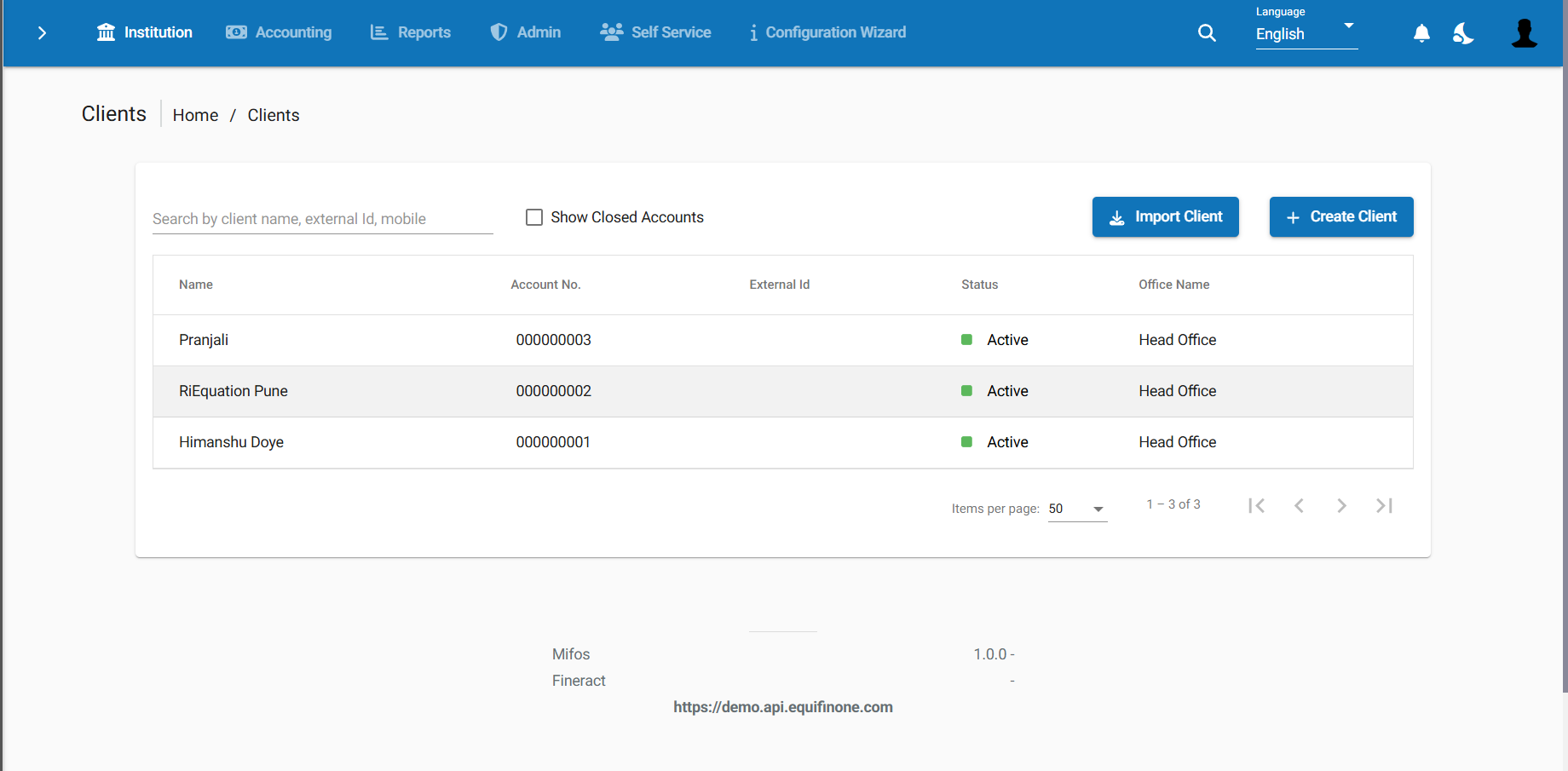

2. Onboard Clients & Operate

Register clients, groups, or organizations. Start disbursing loans, recording repayments, and automating transactions across branches through Fineract’s robust APIs.

3. Scale & Optimize

Integrate analytics tools, monitor portfolio health, reduce risk with automated alerts, and scale operations seamlessly to serve thousands of clients.

Key Product Features

Everything you need to digitize and automate financial services under one unified platform.

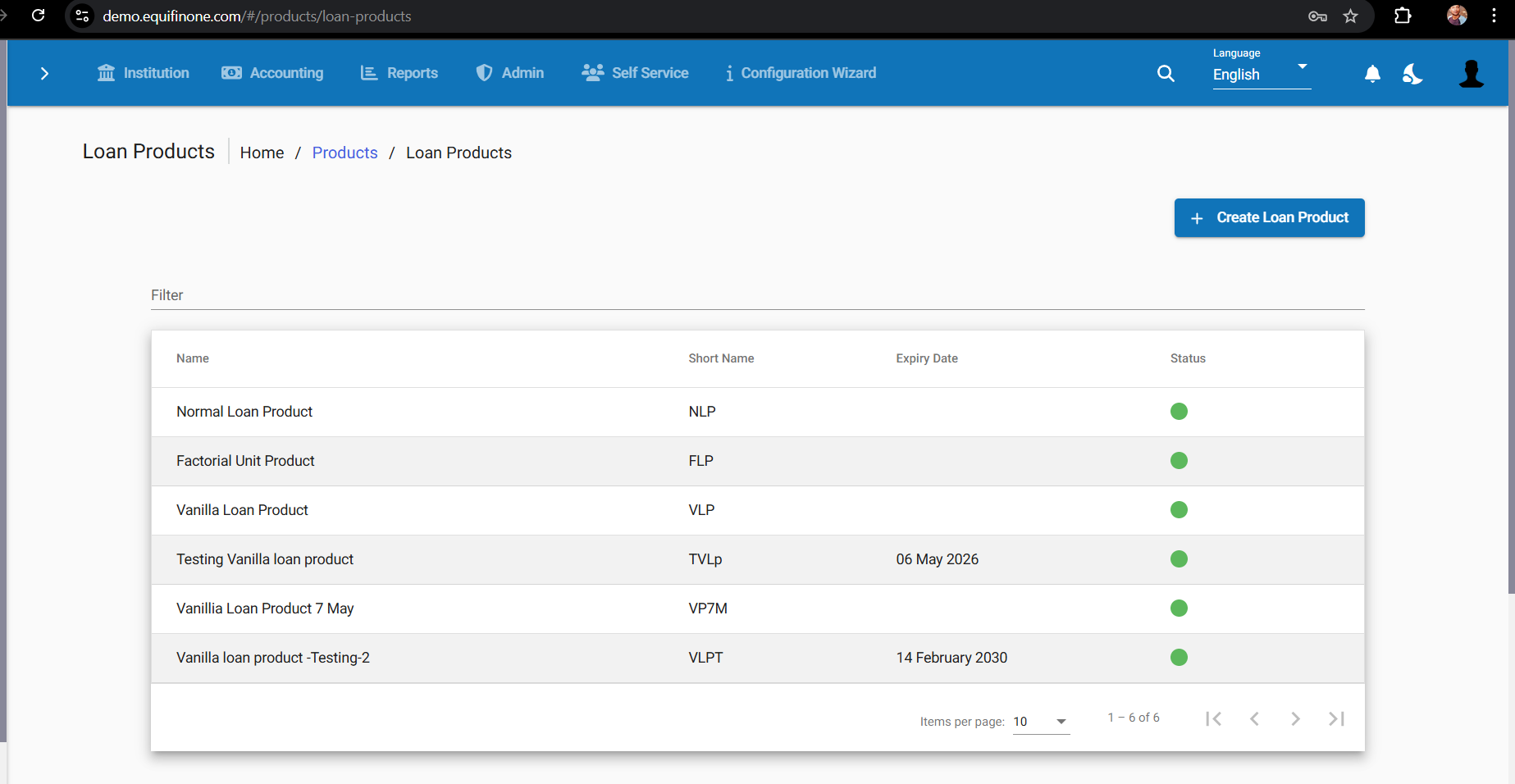

Loan Product Management

Flexible configuration of diverse loan types including term loans, revolving credit, and overdrafts. Customize interest rates (flat, declining), repayment schedules (EMI, bullet), grace periods, charges, and multi-stage approval workflows to suit institutional policies.

Factoring Unit Product Support

Enable invoice-based financing for MSMEs with credit limit assignment, invoice upload and tracking, client-wise risk controls, auto-linked repayments, and aging-based reminders to improve working capital efficiency.

Savings Products

Create and manage multiple types of savings accounts with tiered or flat interest rates, minimum and maximum balance enforcement, dormant account handling, withdrawal limits, and automated interest postings.

Share Products

Track member ownership with detailed share issuance, transfer between members, dividend declarations, and integration with core accounting for equity representation in balance sheets.

Fixed Deposit Products

Offer time-bound FD accounts with configurable interest payout frequencies (monthly, quarterly, maturity), early withdrawal rules, penalty deductions, and automatic maturity payouts to savings or loan accounts.

Recurring Deposit Products

Automate installment-based savings products where users deposit fixed amounts periodically. Support flexible tenures, missed installment penalties, early closures, and maturity tracking.

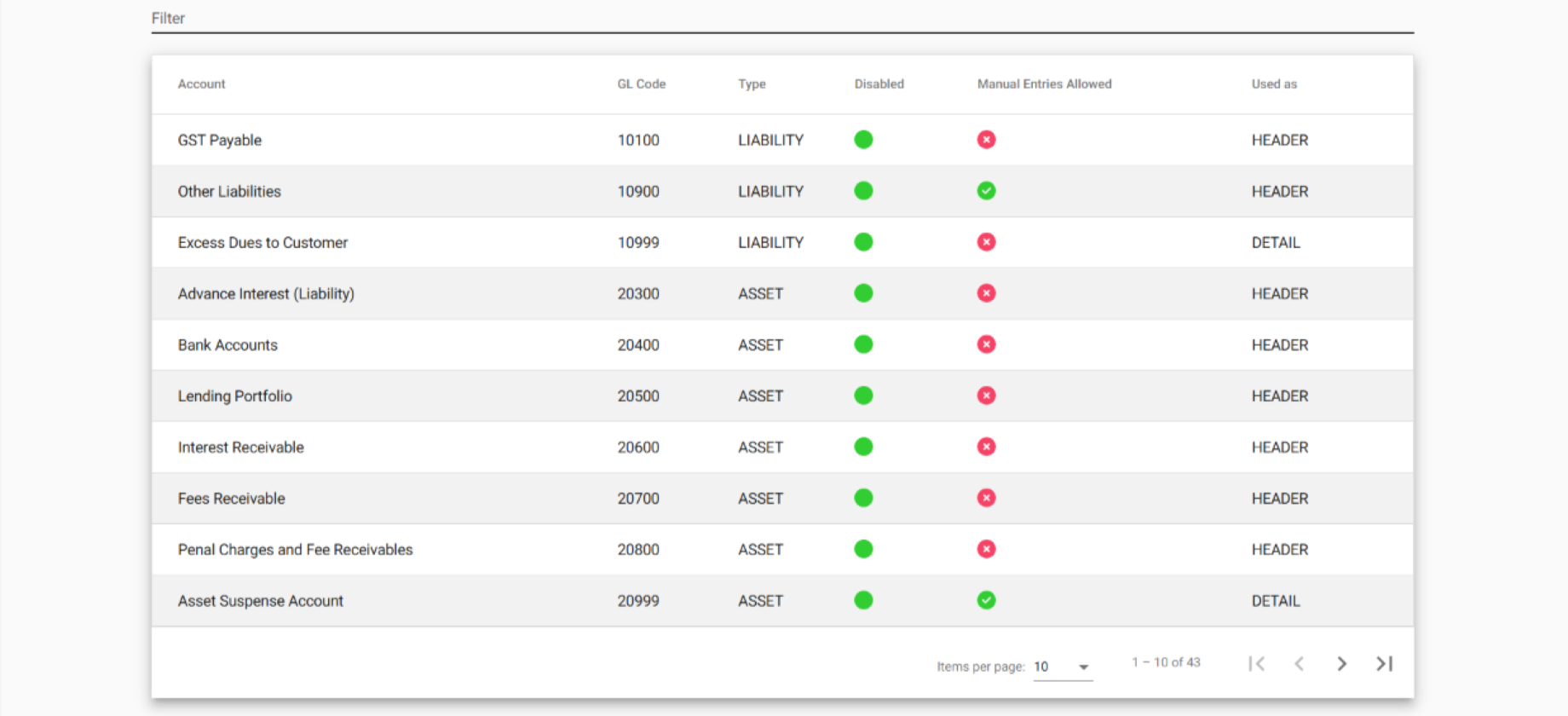

Integrated Accounting Module

Robust financial accounting system built-in with a full chart of accounts, journal and contra entries, automatic postings from loan and savings transactions, trial balance, general ledger, cash flow reports, and audit-ready books.

Role-Based Access Control

Ensure secure and structured access with role-specific permissions for system admins, branch managers, loan officers, auditors, and support teams. Define workflows, approval limits, and access scopes at a granular level.

Custom Reports & Dashboards

Design and schedule detailed reports and live dashboards for performance monitoring, regulatory compliance, financial health, and operational KPIs. Export in multiple formats and integrate with external BI tools if needed.

Built to Help You Grow

EquiFinOne integrates seamlessly into your operations—streamlining financial workflows, boosting efficiency, and helping you scale faster. Book a quick demo to see it in action.

Book Demo